PitchBook UK Market Snap Shot Q4 2024

- Series A

- Series B+

Author Commentary:

Our Country Snapshot series provides an overview of both macroeconomic and microeconomic trends in the region, covering various countries across Europe.

We look at how both public and private data points have trended in Q4 for the UK. Highlights include:

Macro🔗

The UK economy showed minimal growth in Q4 2024, with gross domestic product (GDP) expanding by just 0.1% quarter over quarter (QoQ). Inflation remained a

focal point with the Consumer Price Index (CPI) at 2.5% despite the Bank of England’s (BoE’s) continued efforts to control price increases. In November, the BoE reduced its benchmark interest rate to 4.75%, marking a sustained effort to ease borrowing costs despite wage growth sitting at 6% in Q4. Since then, the BoE has cut rates again to 4.5%. Unemployment ticked up slightly to 4.4% in Q4.

Consumer confidence hovered at 99, slightly below long term trends, as households remained cautious amid mixed economic signals. Business confidence, on the other hand, dipped slightly to 97.9, reflecting uncertainties inthe manufacturing and services sectors, which saw Purchasing Managers’ Index (PMI) readings of 47 and 51.1, respectively. Despite a strong pound, trading at $1.25 against the US dollar, a

degree of economic uncertainty remains at the star of 2025.

Public equity markets🔗

The UK stock market saw significant recovery in 2024, with the FTSE 100 posting a 9.7% year-to date (YTD) return, ahead of other European indices. The index's price/earnings (P/E) ratio reached 16.2x, the highest in three years, driven by robust performance in basic materials and consumer services as take-private activity also supported valuations. On the other hand, the consumer goods and industrial sectors underperformed.

Public listings remained limited, with only four initial public offerings (IPOs) in Q4. Throughout 2024, the IPO market saw listings mainly from non-backed companies, suggesting a approach by privately backed companies towards public offerings. The most significant IPO announcement was SHEIN’s planned 2025 listing, indicating potential for a stronger pipeline in the coming year, although the company’s valuation remains in question, as does a change in the tax loophole that SHEIN benefits from in various end markets.

Venture capital🔗

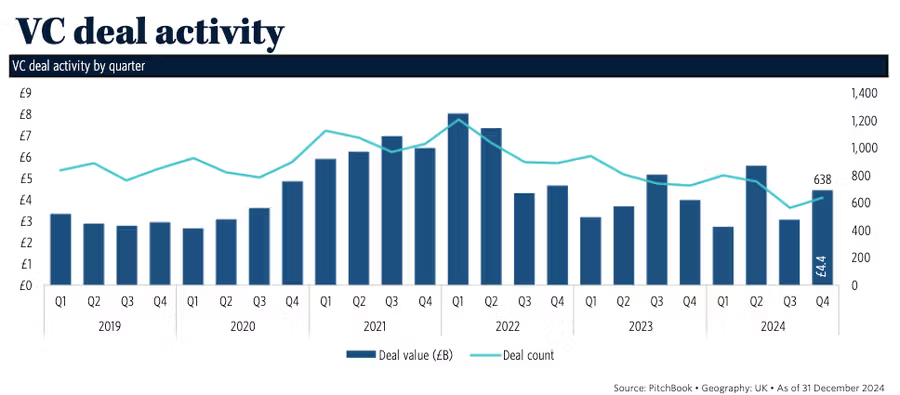

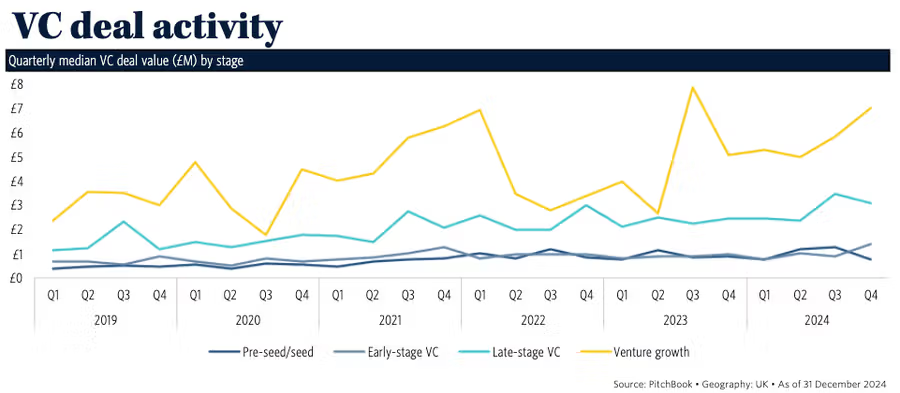

Dealmaking in the UK venture capital (VC) market increased in Q4 with total VC investments of £4.4 billion. The largest deals included GreenScale’s £1 billion early-stage round, followed by Lighthouse’s £287.7 million venture-growth funding and ZEPZ’s £201.8 million investment. By region, outside of the top three incumbents (London, Cambridge, and Oxford) , Bristol and Manchester made the top five for VC deal value. By VC deal count, Edinburgh was the third highest, followed by Manchester. Oxford lagged in deal volume but ha d

the highest median valuation .

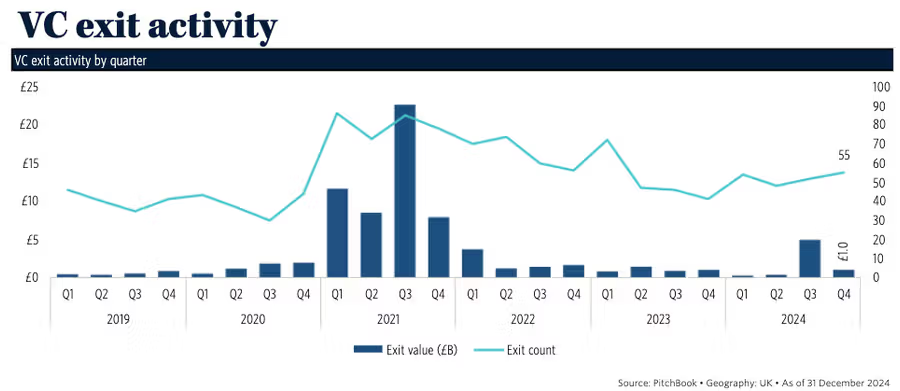

Exit value declined in Q4 following notable acquisitions in life sciences and artificial intelligence (AI) during the year. In 2024, the largest VC-backed exit was EyeBio’s £2.4 billion sale, followed by Rezolve Ai’s £1.4 billion reverse merger. Fundraising activity remained strong, with £6.1 billion raised across 51 funds YTD, led by large closes from Index Ventures and Atomico. Several large, more specialized vehicles involving climate tech and life sciences mandates remain open in the UK.

Private equity🔗

Private equity (PE) activity in Q4 increased to exceed 2023 levels. PE deal value reached £39.3 billion during the quarter, reflecting sustained investor interest despite economic headwinds.

The largest deal was the growth/expansion round in insurance group The Ardonagh Group for £11.1 billion. This was followed by megadeals for AGS Airports and Vantage Data Centers. By sector, finance transactions gained, while business tolost share.

Exit value totalled £9.6 billion in Q4, led by the £2.7 billion sale of Evri and a £1.6 billion exit from Edinburgh Airport. Fundraising remained robust, with UK PE firms raising £47.7 billion YTD, driven by mega funds such as Eighth Cinven Fund (£13.2 billion) and major closes from Apax Partners and Vitruvian Partners.

In other news🔗

In Q4, the budget was front and centre for financial markets in the UK. The upcoming increase in carried interest tax from 28% to 32% in April 2025, and its reclassification as income in 2026, could impact future deal flow and fund structuring. Also in Q4, the chancellor confirmed the government’s commitment to PISCES, the trading platform for privatehares. It plans to legislate for its establishment by May 2025. A consultation by the Financial Conduct Authority that was launched in December is scheduled to conclude in February, marking another milestone for the exchange.

Meanwhile, the CEO of the National Wealth Fund, the UK’s sovereign wealth fund, stepped down in February. Overall, the nature and rate of deployment from the fund have not been clear since the £5.8 billion investment for clean technologies was announced. For instance, the fund recently invested £28.6 million in Cornish Metals to aid the opening of a tin mine in Cornwall, posing questions around the nature of investments in the five cleantech sectors initially outlined.